Navigation

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

More options

-

ODT Gun Show & Swap Meet - May 4, 2024! - Click here for info

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Search results for query: *

- Users: gh1950

- In Finance / Investing

- Content: Threads, Posts

- Order by date

-

Capital Gains/Inheritance Tax?

Or unless the legatee makes it his principal residence, is over 65, and sells it, and takes a one time lifetime exemption on all the "profit" - as you can see, it's really easy to figure out. My word of advise, worth what you are paying for it, you are talking about inherited property which...- gh1950

- Post #7

- Forum: Finance / Investing

-

Capital Gains/Inheritance Tax?

Basis in inherited property is FMV at the time of the owner's death. Time frame of sale is irrelevant. See Granite3 post. People get all whipped up about the "death tax", but it only effects a minuscule number of people. Plus the people if affects can afford the lawyers and accountants...- gh1950

- Post #5

- Forum: Finance / Investing

-

Who here does estates and trust law? Any recommendations?

Correct. But if your father used pre-tax dollars to fund the account, those dollars are coming to you tax free. You are only paying the tax on the gain, which in a climate of 2% interest isn't going to be much. You don't really have problem.- gh1950

- Post #20

- Forum: Finance / Investing

-

Who here does estates and trust law? Any recommendations?

The insurance company is going to write the check to whoever is named the beneficiary on the policy. Nothing you can do can stop that. There is a confusion in terminology. A life insurance company wrote the policy, but it's not an insurance policy. From what you are saying, it's a deferred...- gh1950

- Post #11

- Forum: Finance / Investing

-

Who here does estates and trust law? Any recommendations?

I would ask a lot more questions about why you would pay income tax on a life insurance policy. Life insurance policies are a common device to pass money on without taxation. Unless the annuity was part of some sort of retirement plan, where income tax was deferred until the money was taken out.- gh1950

- Post #7

- Forum: Finance / Investing

-

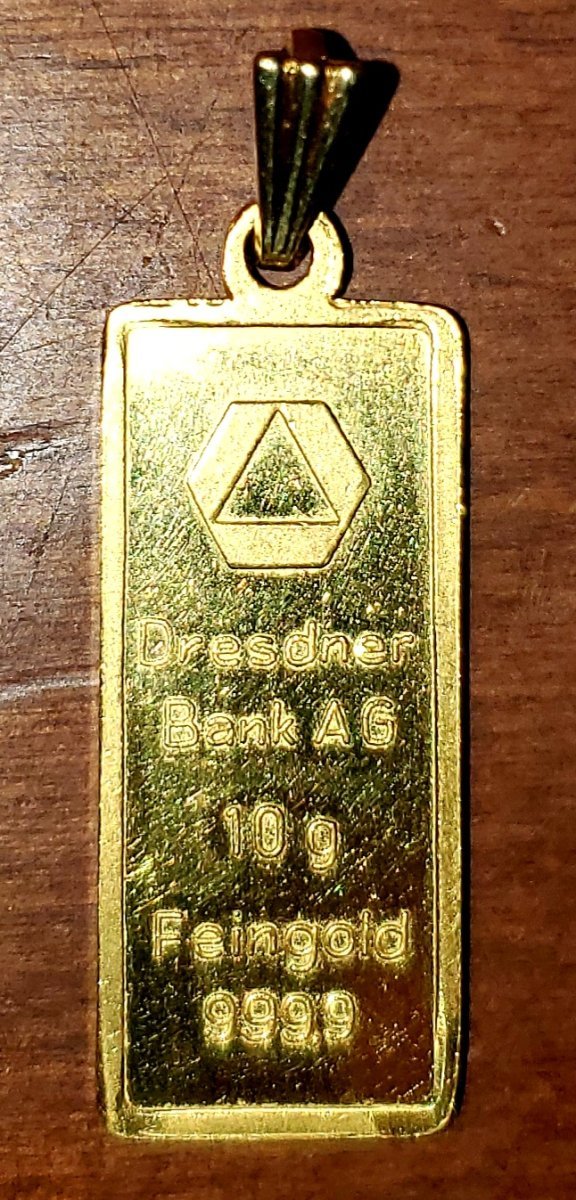

Gold value?

in English, it's also a verb, which translate differently.- gh1950

- Post #11

- Forum: Finance / Investing

-

Gold value?

The "Holocaust victims stolen goods" including their fillings and false teeth that were extracted after they were gassed. Be careful what you wish for.- gh1950

- Post #2

- Forum: Finance / Investing

-

Educate me!

This is not some alarmist deep state conspiracy theory thingy, but some facts. A couple years back I worked on a couple of projects that involved some of the major world banks, and their global investments across several types of investment. First, and this is something you can take to the...- gh1950

- Post #43

- Forum: Finance / Investing

-

Educate me!

If you want to buy silver at spot, then start haunting estate sales and auctions. Sterling silver dinnerware and jewelry will sell at spot - but then you have to be aware of any buyer's premium and sales taxes. It's sad, but right now there is no premium on any old sterling that's not a bona...- gh1950

- Post #30

- Forum: Finance / Investing

-

Mortgage people - whats the deal with these new mortgage insurance rules and offers??

Have to disagree. The facts as you state regarding default are correct. The catch is the the interest the lender charges is supposed to include the default rate, and other costs, including the time value of money. The risk of default is supposed to spread across all the borrowers through the...- gh1950

- Post #72

- Forum: Finance / Investing

-

Refinancing my house questions

https://www.cnbc.com/2017/05/02/a-simple-trick-could-save-you-thousands-on-your-mortgage-payment.html- gh1950

- Post #52

- Forum: Finance / Investing

-

Refinancing my house questions

In Georgia, and most states,residential real estate loans can be pre-paid in whole or in part as a matter of law. I believe the feds have some regs to that effect, but I haven't kept up with them. Used to the lender could charge a prepayment penalty but that has been changed on residential...- gh1950

- Post #49

- Forum: Finance / Investing

-

Anyone here buy stocks?

This. Please study up on the role of different financial advisors. A broker makes money from transactions. Good, bad, sideways, - he gets a commission. The biggest thing to remember about using a broker is that he has no fiduciary duty to you. If the firm tells him to move a certain stock...- gh1950

- Post #131

- Forum: Finance / Investing

-

Anyone here buy stocks?

Late to the party. I have consistently beat the S&P 500 for 30 years. It's not that hard to do. What it requires is discipline and not reading the newspapers. You can read the posts in this thread to see that most people don't have the patience or discipline to successfully invest in this...- gh1950

- Post #103

- Forum: Finance / Investing

-

Payoff the Mortgage or Invest?

I suppose there's some reason you only quoted half of my statement.- gh1950

- Post #49

- Forum: Finance / Investing

-

Payoff the Mortgage or Invest?

Most of them lost their homes because the banks were making loans that defied all traditional lending practices. I did a multi-year deep dive on this and I still don't understand how no one went to jail, except for the fact that the "leaders" of both parties are beholden to the big banks...- gh1950

- Post #41

- Forum: Finance / Investing

-

Payoff the Mortgage or Invest?

This. This is the most painless way to pay your house off early. (splitting your monthly payment into 2 payments. ) Budget wise for you, you won't even notice it. in simplest terms, you are proposing using borrowed money to make passive investments. This almost never works out. You will do...- gh1950

- Post #40

- Forum: Finance / Investing

-

Question for coin collectors/ silver experts

Not a coin collector, but my mother had a massive set of Towle Old Master silverware. Melt was the best price we could get. Unless there is some collector value above and beyond the value of the metal, melt is what you will get. I share your feelings, the silverware was a lifetime effort by...- gh1950

- Post #26

- Forum: Finance / Investing

-

Swiss Bank Acount

Target has the most advance facial recognition lab in the United States. It donates its services to local LEO and the FBI, which doesn't have as advanced capability.- gh1950

- Post #20

- Forum: Finance / Investing

-

IUL Insurance...

ANY universal life is a rip-off, plain and simple. What it plays on is that most people are convinced that life insurance is a gamble, and they want to make sure they don't "lose" all that money they are paying for premiums. Term life is pretty much as pure an insurance product as you will...- gh1950

- Post #4

- Forum: Finance / Investing